Air Lender Appraisal Certification Form 2010-2026 free printable template

Show details

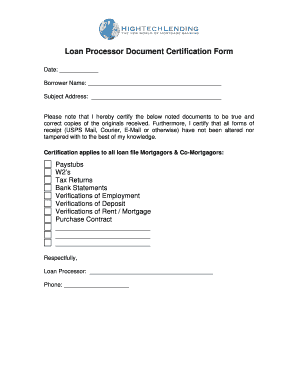

AIR Lender Appraisal Certification Form hereafter known as Lender certifies the following is accurate regarding the completion of the attached appraisal for the property address referenced below. Borrower Name MSI Loan Property Address City/State/Zip Appraisal Dated Undue Influence Controls The appraiser was selected by Lender using criteria based on the appraiser s qualifications proximity to the subject property and other factors determined by Lender to ensure compliance with the appraisal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign air cert appraisal example form

Edit your air certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your air cert form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit air lender form blank online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appraiser independence requirements air are and the overall housing industry form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out air cert for appraisal form

How to fill out Air Lender Appraisal Certification Form

01

Obtain the Air Lender Appraisal Certification Form from the relevant financial institution or online.

02

Begin by entering the date at the top of the form.

03

Fill in the property address where the appraisal will take place.

04

Provide the name of the borrower and the lender involved in the transaction.

05

Enter the loan number associated with the property.

06

Complete the sections detailing the type of appraisal required (e.g., residential, commercial).

07

Specify the intended use of the appraisal (e.g., mortgage lending, refinancing).

08

Sign and date the certification section of the form to verify the information provided.

09

Submit the completed form to the lender or the relevant financial institution.

Who needs Air Lender Appraisal Certification Form?

01

Mortgage lenders who require an appraisal to assess the value of a property.

02

Borrowers seeking a loan for purchasing or refinancing a property.

03

Appraisers who need certification for their appraisal work related to lending.

04

Real estate agents involved in transactions that require appraisal certification.

Fill

guide to the air lender property involved establishing necessary identification

: Try Risk Free

People Also Ask about what is an air cert for an appraisal

Is hvcc still in effect?

The Home Valuation Code of Conduct has now been retired by Congress with the Dodd-Frank Act.

What is air compliance?

The Air Compliance Program uses all compliance tools and resources available to improve air quality by ensuring that air pollution sources are in compliance with state and federal air pollution laws, rules, and permits. Voluntary compliance and pollution prevention are used when working with the regulated community.

What vaccination is required for hvcc?

MMR Immunization Form (PDF) New York State law requires that all students born on or after January 1, 1957, and who enroll in six or more credits for any given term must provide proof of immunity to measles, mumps and rubella (MMR).

What is air certification?

An air operator's certificate (AOC) is the approval granted by a civil aviation authority (CAA) to an aircraft operator to allow it to use aircraft for commercial purposes. This requires the operator to have personnel, assets, and system in place to ensure the safety of its employees, and the general public.

Do you need to be vaccinated to attend hvcc?

Students enrolled in Health Science programs that have a hospital clinical component, must have the appropriate vaccinations and/or immunizations to attend clinical rotations and therefore complete these programs.

What is an appraisal transfer letter?

The “Transfer Letter” is to include the following statement: a) (Transferring Lender's Name) certifies that this appraisal was prepared in ance with and meets all requirements of the Agencies' Appraisal Independence Requirements (AIR) and is in compliance with the Truth in Lending regulations.

What does air compliant mean?

Appraiser Independence Requirements (AIR) are a set of standards designed to replace the Home Valuation Code of Conduct (HVCC). The main objective was to preserve the intent of HVCC while continuing to improve security for mortgage investors, lenders, real estate brokers, home buyers, and the overall housing industry.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify air lender appraisal certification form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including what is air certification. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit appraisal air cert on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign air cert appraisal on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit prohibited data on an Android device?

The pdfFiller app for Android allows you to edit PDF files like air appraisal. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is Air Lender Appraisal Certification Form?

The Air Lender Appraisal Certification Form is a document used to certify that appraisals conducted for air transportation loans meet the required standards and regulations set by governing authorities.

Who is required to file Air Lender Appraisal Certification Form?

Lenders that provide loans for the purchase or operation of aircraft are required to file the Air Lender Appraisal Certification Form to ensure compliance with appraisal standards.

How to fill out Air Lender Appraisal Certification Form?

To fill out the Air Lender Appraisal Certification Form, the lender must provide information related to the appraisal process, including details of the appraiser, property valuation, and compliance with applicable regulations.

What is the purpose of Air Lender Appraisal Certification Form?

The purpose of the Air Lender Appraisal Certification Form is to verify that the appraisal used for aircraft finance transactions is conducted properly and complies with industry standards.

What information must be reported on Air Lender Appraisal Certification Form?

The form must report information such as the appraiser's qualifications, the method of appraisal, valuation results, and confirmation that the appraisal meets regulatory requirements.

Fill out your Air Lender Appraisal Certification Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appraiser Independence Requirements Air is not the form you're looking for?Search for another form here.

Keywords relevant to what is an appraisal air cert

Related to what is air certification appraisal

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.